Modern Monetary Theory Isn’t Helping

MMT is billed by its advocates as a radical new way to understand money and debt. But it’ll take more than a few keystrokes to change the economy.

When we dream it, when we dream it, when we dream it

We’ll dream it, dream it for free, free money

Free money, free money, free money, free money, free money, free money

Now that policies made famous by Bernie Sanders, like Medicare for All and free college, and newer ones like the Green New Deal, are infiltrating the political mainstream, advocates are always faced with the question: “how would you pay for them?” Although there are good answers to “this question” that could even be shrunk down to a TV-friendly length and vocabulary, they’re not always forthcoming. Even self-described socialists seem to have a hard time saying the word “taxes.” How lovely would it be if you could just dismiss the question as an irrelevant distraction?

Conveniently, there’s an economic doctrine that allows you to do just that: Modern Monetary Theory (MMT). Newly elected Rep. Alexandria Ocasio-Cortez is at least MMT-curious, and it’s all over Marxist reading groups and Democratic Socialists of America chapters. It’s even seeping into the business press — Bloomberg’s Joe Weisenthal is friendly to the doctrine. James Wilson of the New York Times tweeted recently, “The speed with which young activists on both left and right are migrating toward MMT is going to have a profound effect on US politics in the 2020s and 2030s.”

While adherents strenuously profess that MMT is subtler and more complex than this, its main selling point is that governments need not tax or borrow in order to spend — they can just create money out of thin air. A few computer keystrokes and everyone gets health insurance, student debt disappears, and we can save the climate too, without all that messy class conflict.

That’s a bit of a caricature, but as we’ll see, not an outlandish one.

At the center of MMT is a small group of academics, reinforced by a fervent army of acolytes on social media. Leading academic names include L. Randall Wray, now of the Levy Institute at Bard College; Stephanie Kelton at Stony Brook; Scott Fullwiler of the University of Missouri at Kansas City (UMKC, which has served as the MMT’s Vatican — both Wray and Kelton spent many years there); Pavlina Tcherneva, also of Bard (though she got her PhD and spent six years at UMKC). Though not a core member of the club, James Galbraith of the University of Texas, a prominent progressive economist, is a fellow traveler. Hovering above, behind, and around them is the figure of Warren Mosler, who runs a hedge fund, holds forth on MMT, and writes big checks in support of the cause. Mosler, whom Galbraith has described as a “national treasure,” isn’t afflicted with false modesty: he calls his blog “the center of the universe” and on it quotes a description of his very slender book Soft Currency Economics as “The most important book ever written.” He lives in the US Virgin Islands because it is a tax shelter with nice weather, a point worth keeping in mind when we look more closely at MMTers’ thoughts on taxation.

Two founding documents of MMT both came out in 1998: Wray’s book Understanding Modern Money and Kelton’s paper “Can Taxes and Bonds Finance Government Spending?” Both argue for several points that remain central to MMT today: governments designate the one official currency for a country by accepting only that unit for the payment of taxes. And a “monetarily sovereign” government — the United States is one, Greece isn’t (because of the euro), Brazil’s status is ambiguous (since it issues its own currency but has nowhere near the power or autonomy of the US) — can issue that currency without limit. As Wray put it, “The government does not ‘need’ the ‘public’s money’ in order to spend; rather the public needs the ‘government’s money’ in order to pay taxes. Once this is understood, it becomes clear that neither taxes nor government bonds ‘finance’ government spending.” You might be wondering where income earned on the job fits into all of this, but the world of production doesn’t play a large role in the theory.

But having tempted us into thinking that taxes were dispensable, Wray pulls a bait and switch. Since there is a risk that too much government spending would spark inflation, the government might need to cool things down, meaning create a recession — though Wray shies away from using the word — by raising taxes. Taxes, MMT holds, should be used as tools of economic management, but must never be thought of as “funding” government. To think that would be to indulge in an orthodox superstition.

Kelton’s paper foreshadowed what would become a trademark of MMT writing: detailed accounting exercises designed to show what happens, mechanically speaking, when the government spends money. These are mobilized to ask “why should the government take from the private sector the money . . . that it alone is capable of creating? . . . Indeed, the entire process of taxing and spending must, as a matter of logic, have begun with the government first creating (and spending) new government money.” Government is as a God, giving economic life through spending: until it spends, we have no money. Taxes and borrowing are merely means to manage the level of reserves in the banking system.

Much of the MMT literature is an elaboration of the arithmetic of bank reserves, the money banks set aside as a backstop against a run, in the form of cash in the vault or deposits held at the central bank. Reserve accounting is important if you’re a financial economist or a central banker, but it’s of limited relevance to anyone concerned with big-picture economic questions. Absent from Kelton’s paper, Wray’s book, and much of the subsequent MMT literature, is any sense of what money means in the private economy, where workers labor and capitalists profit from their toil and compete with each other to maximize that profit, a complex network of social relations mediated by money.

Although the politics of MMT lean left, the angle of the tilt is hard to measure precisely. Mosler was described by a colleague as “politics agnostic”; by Yves Smith of Naked Capitalism, a promoter of the school, as a “conservative.” Wray has said MMT is compatible with a libertarian, small government view of the world. Kelton, in an interview with the activist and journalist Nomiki Konst in which she describes MMT as a “brand,” graciously concedes that “Marx was important at some point.”

Despite advertising its modernity with its name, MMT has roots going back over a century. Its earliest precursor is The State Theory of Money by the right-wing German economist Georg Friedrich Knapp, published in 1905. It is an odd book. Using a cascade of terms like “hylolepsy” and “synchartism,” Knapp argues that the state names the currency by law, and by the practice of only accepting tax payments denominated in that currency. This doctrine, known as chartalism, is in one sense incontrovertible; states feel very strongly about their currency and punish people who counterfeit it. You must pay taxes in the official currency or you will go to jail. No modern country not in crisis would tolerate multiple currencies circulating in its borders (though the dollar didn’t become the sole legal US currency until 1863). But how that official currency relates to the rest of society is barely addressed.

A second ancestor of MMT, and one its proponents cite frequently, is a 1946 paper by the New Deal adviser and businessman Beardsley Ruml that appeared in American Affairs: A Quarterly Journal of Free Opinion, a publication of the then quite conservative National Industrial Conference Board. The eccentric Ruml, identified in the magazine’s notes on contributors as “an audacious thinker,” declared in the title of his essay that “Taxes for Revenue are Obsolete.” The central claim is in this passage:

The necessity for a government to tax in order to maintain both its independence and its solvency is true for state and local governments, but it is not true for a national government. . . . Final freedom from the domestic money market exists for every sovereign national state where there exists an institution which functions in the manner of a modern central bank, and whose currency is not convertible into gold or into some other commodity. The United States is a national state which has a central banking system, the Federal Reserve System, and whose currency, for domestic purposes, is not convertible into any commodity. It follows that our Federal Government has final freedom from the money market in meeting its financial requirements.

It’s an early statement of the MMTers’ favorite hobbyhorse: taxes might be useful to tinker with the income distribution, or discourage vices, or to fight inflation by draining purchasing power from the economy. But governments don’t really need the revenue — they can just print the money.

Since Ruml’s essay is based on pure assertion, his oracular status among MMTers seems to come from his role as chair of the Federal Reserve Bank of New York. But that’s mostly an honorary post. (Its current occupant is Sara Horowitz, founder of the Freelancers Union.) He had no special knowledge of central banking or fiscal politics. In the 1920s, Ruml doled out money for the Rockefeller Foundation. In 1926, he gave some of that money to the Geneva Institute, a Swiss think tank that would become, in the historian Quinn Slobodian’s words, “an important institutional hub for the future neoliberals.” Ruml’s day job at the time he wrote the American Affairs essay was as chair of Macy’s, a role he took after years of service as its treasurer.

An occasional subject for New Yorker profiles in the 1940s and 1950s, Ruml also served on a number of corporate boards, including that of Muzak, whose aural product he recommended to a “Talk of the Town” reporter as a great way to improve productivity by 18 percent among people doing “monotonous” work. Perhaps not coincidentally, more than half of his American Affairs essay is devoted to denouncing the corporate profits tax as “evil,” part of Ruml’s campaign, outlined in a three-part 1945 New Yorker profile, to eliminate it.

MMTers mostly forget about this part of the Ruml oeuvre: though Warren Mosler, writing in the Huffington Post, acknowledged that Ruml “was writing about the merits of corporate taxes,” he didn’t reproduce Ruml’s characterization of them as evil, which might have alienated HuffPo’s liberal audience.

Aside from Knapp and Ruml, MMTers take inspiration from the economist Abba Lerner, in particular his 1943 paper, “Functional Finance and the Federal Debt,” which is neither outlandish nor right-wing. It was written in the middle of World War II, when fiscal prudence didn’t merely take a back seat to the war effort, it wasn’t even in the vehicle. Because of the war experience, all the old rules of balanced-budget fiscal orthodoxy seemed utterly antique, and the conviction grew that clever fiscal management could tame the business cycle and minimize unemployment.

Lerner’s opening sentence expresses a wish for the postwar world: “Apart from the necessity of winning the war, there is no task facing society today so important as the elimination of economic insecurity.” His proposed doctrine of functional finance held that “government fiscal policy, its spending and taxing, its borrowing and repayment of loans, its issue of new money and its withdrawal of money, shall all be undertaken with an eye only to the results of these actions on the economy and not to any established traditional doctrine about what is sound or unsound.” In other words, if unemployment is rising, loosen policy (boost spending, cut taxes, lower interest rates), and if inflation is rising, tighten policy (the reverse). On first glance, this sounds completely reasonable. But on second, it’s a lot more complicated.

For one thing, it often takes time to understand what’s going on in the economy, and it takes even more time to change policy — and sometimes, like in the 1970s, unemployment and inflation are both rising, and it’s not obvious what policy should do in response. Anyone who’s watched Congress struggle with tax and spending policy has to wonder how anyone could believe that fiscal policy could be fine-tuned with requisite speed and precision.

MMTers extend this hubris about the precision and power of policymaking to the realm of interest rates, which they think the central bank is completely in control of and should be kept as close to zero as possible. (Mosler thinks rates should actually be zero.) Although MMTers tend to talk casually of “the” interest rate, in fact there are many. Long-term government bonds, for example, are almost always going to carry higher rates than short-term ones, because so many more unpredictable things can happen before the bond reaches maturity. And either is going to yield less than a bank loan of similar maturity to an oil wildcatter or the corner bodega, because of the higher risk of default.

Without higher interest rates to compensate for greater default risk or longer maturities, there will simply be no one willing to buy the bonds or issue the loans. MMTers would answer that the Federal Reserve (or any comparable central bank around the world) could buy up the bonds instead. But that would, if carried to extremes, run the risk of runaway inflation — and it still wouldn’t help the wildcatter or the bodega owner. MMTers say little about how far this process could be carried on.

That brings us to the next problem: inflation. When the printing presses run freely, it’s not only reactionaries who think that runs the risk of spiraling prices. As I was researching this piece, many people to whom I described MMT, from Democrats to Marxists, brought it up as a worry. MMTers are coy about the topic — they never say how much is too much, and they profess great confidence in their ability to control it. In a paper criticizing MMT, the left-Keynesian economist Thomas Palley says he’s heard a “leading” MMTer say inflation less than 40 percent is “costless.” That’s nearly three times the modern US record of just under 15 percent in 1980, which was widely regarded, and not just by bondholders, as a crisis. Since wages typically lag behind price changes, inflations can lead to real declines in living standards.

Though it might scandalize some liberals to say so, it’s dangerous to be sanguine about inflation. People find it destabilizing and it feeds a hunger for order. The rise in inflation through the 1970s that climaxed in that 15 percent record helped grease the way for Reagan. The extreme inflation of Weimar Germany in the 1920s contributed to the rise of Hitler. As a British diplomat stationed at the embassy in Berlin wrote to his bosses at home during the hyperinflation: “The population is ripe to accept any system of firmness or for any man who appears to know what he wants and issues commands in a loud, bold voice.”

The standard view of the Weimer inflation is that the German economy, severely damaged by World War I and forced to make huge reparations payments to the victors, wasn’t up to the task — it just didn’t have the productive capacity, and its citizens were both unwilling and unable to pay the necessary taxes. So instead the government just printed money and spent it, not only to pay its own bills, but to support bank lending to the private sector. (The printing presses were so overworked that they had trouble keeping up with the demand for fresh banknotes. At least keystroke money wouldn’t face this problem.) Inflation peaked at 29,500 percent in October 1923, meaning that prices doubled every four days. The value of the mark collapsed from 320 per US dollar in early 1922 to over 4 trillion per dollar in late 1923, meaning the mark lost 99.999999992 percent of its value in a year and a half. The value of the real wage, if it’s possible to measure amid such rapid inflation, fell by over 80 percent, as pay badly lagged price increases.

In When Money Dies, a classic popular history of the Weimar inflation, Adam Fergusson wrote that the savaging of living standards brought “hunger, disease, destitution and sometimes death” to the mass of Germans. Hyperinflation was only stopped with a deep austerity program — government spending cuts, layoffs, wage cuts, the usual. Tax payments were linked to gold values, not the worthless notes from the printing press. Unemployment soared. But the inflation ended.

Wray’s explanation of the Weimar hyperinflation, one of the most dazzling of all time, is odd. The deficits, Wray explained in his book, were caused by the inflation, not the other way around. In the end, “Germany adopted a new currency, and while it was not legal tender, it was designated acceptable for tax payment. The hyperinflation ended.” Almost nothing about the printing press — he dismisses “printing money” explanations as “far too simple” — and nothing at all about the austerity program. No, there was just an unexplained monetary intervention somehow linked to tax payments. Weimar Germany may be an extreme case, but since it’s often brought up by critics of MMT — “won’t all that keystroking lead to inflation, like Argentina or Weimar?” — it’s one for which they need to have a good answer. Wray’s reluctance to face head-on the risks of printing money makes you wonder how confident he really is of his own theory.

Another serious problem with MMT is its embeddedness in a rich-country perspective, and in particular American exceptionalism — in this case the “exorbitant privilege,” as a French finance minister once put it, that comes with issuing the world’s dominant currency. Countries around the world keep their reserves (basically rainy-day funds on a very large scale held by governments at their central banks) in dollars, which make them effectively a captive market for US Treasury bonds (which is how the dollars are kept). Also, major commodities like oil are priced in dollars, forcing countries to accumulate the currency to pay for essential imports. That means the United States, exceptionally, can run giant deficits and borrow on a vast scale with little constraint (so far). Nor do we have to worry about the value of the dollar (for now, though you have to wonder how long the exorbitant privilege will last in a world where US dominance is eroding).

But less privileged countries have to worry about foreign investors dumping their bonds and driving down the value of their currency, which would jack up interest rates and inflation. Salvador Allende’s government greatly increased spending and raised the incomes of the poorest in Chile in the early 1970s; that worked nicely for a while, but then inflation took off. Allende wasn’t operating from the MMT playbook, merely resorting to policies pursued by many progressive governments facing political opposition and resource constraints. But such experiments rarely end well, and similar problems would face a poor country trying to stimulate its way to prosperity today, as we see in Venezuela now.

Compared to the United States, such countries enjoy less “monetary sovereignty” — a core MMT concept. A monetarily sovereign state is one that can spend its currency at will, including from pure keystrokes. America enjoys a lot of monetary sovereignty; so do Canada, Japan, and Britain, though to a lesser degree. Those countries need, for example, to import things priced in dollars, like oil, and the value of their currency has a direct effect on living standards that Americans are insulated from because we can print the currency in which that oil is priced. Brazil, in turn, has even less freedom; it needs harder currencies like dollars and euros to import commodities and advanced manufactured goods; and poorer countries like Bolivia or Ghana have even less. To buy essential imports, these countries often have to borrow in those hard currencies. To pay off the loans, they need to earn foreign currency through exports.

MMT has little helpful to say about that situation — in fact, its advocates sometimes seem to lecture them that foreign borrowing is risky, which it is, but sometimes it’s the only way you can buy power plants and locomotives. MMTers like William Mitchell and Wray write as if borrowing abroad is just a bad choice, and not something forced on subordinate economies. When I asked Mosler what MMT had to offer Turkey, a country whose currency has been losing value for the last four years and had something of a financial crisis in the summer of 2018, he responded with a bit of avian whimsy: “Without our recipe for Turkey they’re a dead duck.” (In fact, Turkey had been pursuing MMT-friendly expansionary fiscal and monetary policies, including state guarantees of private corporate debt, and inflation was around 11–12 percent and rising.) Not satisfied with that answer, I said that while I understood the risks of borrowing in a foreign currency, which Turkey had done a lot of, there’s not much sophisticated capital equipment available for sale in Turkish lira. Mosler answered, wrongly, that you could actually buy “a lot” of such goods in lira, and that “Any nation can sustain domestic full employment without imports of capital goods” — totally missing the point that a country looking to ascend in the global economic hierarchy needs investment goods that are only made in countries like Germany or Japan.

Member countries in the euro are a case unto themselves. Greece and the other debtors on the continent’s periphery have little sovereignty — they have big foreign debts in a currency they can’t print. Greece could have left the euro, as many on the Left urged, but that would have been massively disruptive, and even leaving that aside, it wouldn’t have addressed the country’s long-standing structural weaknesses, like an underfunded state and an underdeveloped industrial infrastructure. Symptomatic of that relative weakness: in the twenty years prior to the introduction of the euro, the drachma lost 88 percent of its value. Inflation over that period averaged over 14 percent a year. In 1980, Greek per capita GDP was 73 percent of the US’s; by 2002, that had fallen to 60 percent. In other words, Greece’s economic problems long predate the euro. And even though they don’t literally print the currency, core eurozone countries like Germany and the Netherlands hardly suffer from their formal lack of monetary sovereignty. What matters far more is your place in the global economic food chain — and that can be annoyingly sticky.

MMT’s unacknowledged dependence on the exorbitant privilege of the United States —Mitchell is about the only high-profile MMTer from abroad — is almost completely unaddressed by its proponents.

MMT is an outgrowth of a school called post-Keynesian (PK) economics. In fact, several of the principals met each other on a post-Keynesian thought listserv in the late 1990s. PK economics has several sub-schools, and there’s not much point in getting too deeply into each, but there are some general points about it relevant to a discussion of MMT. Most PKs are left of center, and some are even socialists. They deplore the orthodox turn of a lot of mainstream Keynesians, whom they view as technicians of the business cycle not interested in deeper structural issues. They emphasize the importance of money and credit, particularly their destabilizing possibilities through speculative bubbles, far more than more mainstream sorts, who tend to believe the system is self-equilibrating and money exerts little mischief of its own.

One interesting strand of PK thought is endogenous money theory, which is the opposite of the monetarist theory made famous by Milton Friedman. Monetarists believe the central bank controls the money supply through its power to create and disseminate money via the banking system: the Fed injects cash into the financial system by buying Treasury bonds from private holders (not from the Treasury itself) and then banks are free to lend this newborn monetary hoard. Endogenous money theorists, in contrast, believe that money creation is driven by demand for credit coming from private actors, like businesses and consumers. Banks make loans and then scramble to fund them. Most of the time, the central bank accommodates banks’ demand for fresh money by pumping funds into the financial system (except when it’s trying to provoke a recession by frustrating their lust for fresh reserves). For those who care, this endogenous money view is similar to Marx’s theory of money. It’s also consistent with the way many central bankers see things. In normal times, the central bank injects enough money into the system to keep the wheels of commerce spinning, but it’s not what generates the spin. The work of production and distribution does that.

MMTers junk a lot of the most interesting stuff about PK economics. Unlike Joan Robinson, an early contributor to the PK tradition, they rarely ask what she called “the greatest of all economic questions . . . what is growth for?” (Or, as she said elsewhere, “Now that we all agree that government expenditure can maintain employment we should argue about what the expenditure should be for.”) Inspired by Knapp’s chartalist theory, they minimize the role of private credit demand in driving the economy; like Friedman they believe the government drives the creation of money (Friedman through the central bank, MMT through federal spending). Wray, who once wrote a book on the topic, now dismisses endogenous money as a “trivial advance” next to MMT.

MMTers show a strange lack of interest in the specificity of capitalism — how production and distribution are organized, how demand for credit arises in the course of commerce, how people earn their living and under what conditions — and their rejection of earlier PK work on money renders nearly invisible any link between money and things or money and people (or people and things via money). Marx said a man carries his bond with society in his pocket, a recognition that money is one of our principal modes of social organization and control. Or, as Antonio Negri put it in one of his more lucid moments, money has only one face, that of the boss. If you don’t work and do as you’re told, you go broke and starve.

Through the fantasy of effortless keystroke money, all those relations of necessity and power supposedly get wiped away. But it’s not some imposed scarcity of money itself that produces those relations.

MMT’s lack of interest in the relationship between money and the real economy causes adherents to overlook the connection between taxing, spending, and the allocation of resources. We have homeless people living on the streets of San Francisco blocks from Twitter and Uber’s headquarters, bridges collapsing, trains derailing, schools falling to bits — the entire structure of private opulence and public squalor, as John Kenneth Galbraith put it long ago, because the public sector is starved for resources. Taxing takes those resources out of private hands and puts them into public ones, with at least the potential for them to be spent on more humane pursuits. Fewer Lamborghinis, more bullet trains. Fewer Hamptons houses, more public housing.

Enacting single payer, for example, isn’t just a matter of a few billion extra keystrokes. It means dismantling the absurd administrative apparatus of the US health care system, shifting premiums for private insurance into public expenditures, transforming the price-gouging business model of the drug industry, and taking care of workers displaced by the renovation.

You could say something similar about climate change. Kelton, for example, wrote this on Twitter:

How I imagine the conversation between the last two people on [emoji for Earth]

“There were plans to save humanity, but they didn’t cost out.”

“They should have learned #MMT.”

Keystrokes will save the Earth! Except they won’t. We need a wholesale revamping of our energy and transportation systems, the spatial organization of our cities, and the fundamental processes of industrial and agricultural production. To do that, we need to step on private capital’s freedom of investment, which strikes at the heart of ruling-class power.

MMTers will sometimes say they want to tax the rich because they’re too rich, but Wray said at a recent conference that he sees no point in framing the issue as taxing the rich to expand public services — presumably because government doesn’t need to tax to spend. Elsewhere, he has written that taxing the rich is “a fool’s errand” because of their political power. He told Bloomberg Businessweek he was “a bit disappointed” that Ocasio-Cortez connected tax hikes to the Green New Deal. And he once blamed the devastation of Camden, New Jersey on high tax rates — which makes it hard to explain the wealth of the very highly taxed New York City; the real Camden is lightly taxed and relies heavily on state aid.

It seems that many on the contemporary American left are still under the tax-phobic legacy spell of post-Reagan politics, which makes MMT seem appealing — an easy answer to “how are you going to pay for that?” Shortly before her election to Congress, Alexandria Ocasio-Cortez was stumped by that question in a TV interview with Jake Tapper. Afterwards she met with Kelton and had kind things to say about MMT.

AOC’s defenders quickly noted, correctly (as she herself had earlier), that no one asks that question when it comes to funding the Pentagon or tax cuts for the rich. But there’s a good reason the Pentagon and upper-bracket tax cuts get a pass from the fiscal police. Cruise missiles and making plutocrats even richer reinforce existing social hierarchies. Medicare for All and free college tuition weaken them. Depending on employers for health insurance makes workers more pliable; forcing students to borrow heavily to pay their tuition bills makes them more likely to adhere to the straight and narrow on graduation. Bosses and their hired scribes don’t want to create “new entitlements,” even if single payer could cut their health insurance costs. The last thing they want to do is encourage the population to make fresh demands. It’s much better to keep the masses on their back foot, as the Brits say.

Taxation may not be full expropriation but it’s the next best thing in this fallen world. It is a form, however mild, of socialization — transforming private investment and consumption into public expenditures. And divorcing taxation of the rich from the provision of public services throws aside the material and agitational advantages of waging class war through fiscal politics. Rich people would have a lot harder time complaining about their money being taken to educate kids and save the planet than if it were taken just because they’re too rich.

A critical part of the MMT agenda is a job guarantee (JG), a policy under which the federal government becomes the employer of last resort (ELR). Unlike MMT’s monetary theorizing, the JG has nothing to do with the school’s core chartalist concept, and it deals directly with a crucial aspect of the real economy, namely the labor market. With a JG, the chronically unemployed could find decent work, and the temporarily unemployed would be accommodated until they find permanent work.

For an outline of the JG, we can look at a paper by Pavlina Tcherneva, who’s been the MMT school’s specialist on the proposal. At recent levels of US unemployment, Tcherneva estimates 10–15 million people could be employed in a JG program (which would be another 6–10 percent on top of those who are already working for pay). The additional income earned by those in the JG program would, by increasing demand for goods and services, probably boost employment by another 4 million or so, using standard economic models. That would bring the employed share of the US population to record levels by a comfortable margin, though it would still leave it below Swedish and Icelandic rates.

Tcherneva would have the jobs pay $15 an hour, with full benefits (health insurance, childcare, paid leave, and retirement; her colleague Mosler, hedgie that he is, would set the pay much lower). That works out to an annual income of $31,200, close to the median level of personal income.

By her estimates, and those of her MMT colleagues, the JG would cost 1–2 percent of GDP, though that would be partly offset by reduced spending on unemployment benefits and poverty programs. This is probably an underestimate, but whatever the exact numbers, the budgetary costs would not be remotely crushing.

Care work would be a large part of her JG model, not just because of the social need but also to reach “the least-skilled and most marginalized groups in the labor market.” Traditional infrastructure work disproportionately employs men, and that’s not adequate to the task. She envisions JG workers deployed in care for the environment (drawing on New Deal models like the Civilian Conservation Corps, as well as addressing more modern concerns like reducing food deserts), care for communities (trash removal, school gardens, tool-lending libraries, classes, historical-site restoration), and care for people (elder care, after-school programs, help for former prisoners). For not fully disclosed reasons, Tcherneva and her MMT comrades want to shield the private sector from JG competition. It’s not clear whether public sector workers would enjoy the same shield; it might be tempting, after all, to replace well-paid union labor with workers passing through the JG program.

A JG could exist without the rest of the MMT apparatus. The school’s special tweak on the idea is to conceive of the program as an integral part of macroeconomic regulation. Like economists across the political spectrum, MMTers believe that when the economy exceeds full employment, inflation will result (though they’re vague on the details of when “full employment” happens, or “inflation,” for that matter). To cool inflation, MMTers would raise taxes and/or sell government bonds to reduce purchasing power in the private economy. This would cause a recession, but instead of becoming unemployed, workers would enter the JG program. For the chronically unemployed, a $15 steady wage might look like a half-decent deal, and not living under constant threat of abuse or layoff (because of the government guarantee, and a presumably high bar for being fired) would be a great nonmonetary compensation. But for a lot of workers who would enter the JG program because they lost their regular jobs to a recession, $15 would mark a pay cut — it’s slightly more than half the average hourly wage — and quite possibly a waste of their skills, even if it did stave off absolute penury. That’s softer than the conventional approach, but it’s still not painless.

There’s material to admire in the JG, but there are some problems. The shyness about big infrastructure projects — in another recent paper, Tcherneva and four MMT colleagues explicitly differentiate their JG scheme from the New Deal’s Works Progress Administration (WPA) — is inexplicable. Yes, lots of care work needs to be done, and that would be essential to any humane policy agenda. And yes, infrastructure has a manly prestige that is missing in caring labor, which is often marginalized as “women’s work.” Care work badly needs to be taken far more seriously (though it’s hard to see how having it done by a transient workforce contributes to that). But women can do vital infrastructure work too. Tcherneva et al. quote Nick Taylor’s book on the WPA as saying it brought the United States into the twentieth century. (A look at the Living New Deal’s catalogue of WPA projects shows the degree to which we’re still living on it — schools, highways, hospitals, post offices, airports, harbors, public art — and haven’t really built anything on a comparable scale since.) The JG is not designed to bring us into the twenty-first, unless you think casualized labor is a model for our time.

JG work could fill some important social needs, but how seriously dedicated to serving those needs could the program be if it were staffed by a transient workforce? Sometimes the whole concept sounds like workfare. Invoking that word isn’t just polemic. In a review of a book by the great post-Keynesian economist Hyman Minsky, whose JG program is the direct ancestor of MMT’s, Flavia Dantas, who’s written on the JG for the Levy Institute, cites Minsky (his words are in the embedded quotes): “Although well intentioned,” welfare schemes intended for poverty reduction among those fit to work were “‘poorly thought-out programs’ that appealed to ‘sentimentality with regard to hunger and clichés about consumer sovereignty,’ created government-dependency, and disrupted ‘social cohesion or domestic tranquility.’” (Some of this — “sentimentality with regard to hunger”! — sounds like it was lifted from the Daily Caller.) To Minsky, denying the people the right to work — which he saw as a fundamental human propensity — was a “major social injustice,” in Dantas’s words.

Writing in 1944, Beardsley Ruml of all people offered a persuasive critique of using a JG as a mechanism for regulating the business cycle. Ruminating in a largely orthodox fashion — no proto-MMT kinks here — on the prospects for a postwar fiscal policy, he cautioned against using public works projects as a countercyclical strategy, because of

the human undesirability of bringing hundreds of thousands of men into the construction industry and forcing them out again as an offset to the free play of economic forces elsewhere in the business system. These men are not statistical units that can be properly moved from one column of an accounting sheet to another in order to preserve a general balanced level of employment. Nor can they be shifted long distances from their homes to places and at times convenient to the business cycle.

Despite the advocates’ assurances that they don’t want to compete with private sector jobs, the $15 an hour pay could have a substantial impact on the national wage structure. Though it’s a bit more than half the average hourly wage, it’s at about the thirty-seventh percentile of the wage distribution, meaning 37 percent of workers are paid that much or less. It would be nothing but good to raise their wages, but we should be honest about how disruptive it might be. It would put a lot of low-wage employers out of business — often deservedly so — and force survivors to cut back on staffing, with machines taking the place of people if possible. It would have massively uneven geographic effects. Nearly one in six metropolitan areas — mostly small, and in the South — have a median wage below $15; more than two-thirds, accounting for well over a third of employment, have a median below $18.

Not only would such a program challenge the American wage structure in profound ways, it would change the entire boss-worker relation. In a classic 1943 essay, “Political Aspects of Full Employment,” the economist Michal Kalecki noted — perhaps optimistically — that while Keynesian economic management could assure a low unemployment rate close to zero over the long term, the capitalist class would resist this. One reason is that investment and hiring depend on the confidence of the business class, and they want politicians to be dedicated to keeping that level of confidence high. Shake that confidence and managers will pull back and throw the economy into a slump. You might think that the strong markets of a full-employment economy would appeal to managers and stockholders, but there would be a larger political problem. As Kalecki wrote, “under a regime of permanent full employment, the ‘sack’ would cease to play its role as a disciplinary measure. The social position of the boss would be undermined, and the self-assurance and class-consciousness of the working class would grow. Strikes for wage increases and improvements in conditions of work would create political tension. . . . Their class instinct tells them that lasting full employment is unsound from their point of view, and that unemployment is an integral part of the ‘normal’ capitalist system.”

These disruptions would all be good for the working class, but to the bosses they’d look like quasi-revolutionary acts. When I interviewed Kshama Sawant, the socialist member of the Seattle city council who put a $15 minimum wage at the core of her agenda, in 2015, I asked her how she dealt with how system-challenging it was; she didn’t retreat. She said it was “an all-out class battle” — and if the system can’t pay, which it has a very hard time doing, that becomes a tool for showing that system is bad. That’s the kind of thinking that it will take to get $15 an hour, which would require a very different kind of politics than MMT seems to contemplate.

And if we had a political movement strong enough to force full-employment policies on the state, then why stop with a mere JG? What about democratizing the workplace, reorganizing production to be ecologically sustainable, socializing property via taxation and public spending, and eventually expropriating the capitalist class? If you’re going to challenge ruling-class power, as a JG would do, why stop there?

If the job guarantee is MMT’s most attractive feature, the style of argument habitually employed by its proponents is among the ugliest. A classic example is a response by Wray and occasional collaborator Éric Tymoigne to a fairly friendly critique of the school by the left-Keynesian economist Thomas Palley, in which they accuse him of wanting to combat inflation with unemployment and poverty, a dishonest insult that they compound with this footnote: “Palley has been caught on video complaining that if a JG provides jobs to everyone, the poor will be able to eat . . .” (The video is from an exchange between Palley and Mosler, in which Palley says that providing the unemployed with jobs in South Africa would promote demand for electricity, food, TVs, and other goods that the country doesn’t have the capacity to produce.)

Tymoigne and Wray’s response to Palley barely addressed any of his substantive points — among other things, its vagueness about the causes and consequences of inflation, its naïve belief in the curative powers of fiscal policy, its irrelevance to the problems of poorer countries, its lack of interest in how the JG might tempt anti-worker governments to replace public sector workers with underpaid transients — and just reasserted the catechism, spiced up with some rude caricatures. They also guard their turf jealously. When asked by the liberal economist Dani Rodrik to react to a polite and friendly effort by two left economists to reconcile MMT with more mainstream schools of economics, Kelton pronounced herself “not remotely” comfortable. Rodrik had called the economists’ paper an MMT “explainer”; she urged him to be “careful about labeling any post with MMT in its title an ‘MMT explainer.’” The brand must be protected.

And they can be extremely slippery. If you ask, “Do you really believe the government doesn’t need to tax or borrow to spend,” which is something they frequently do argue, they’ll deny it. When questioned by a sympathetic Ryan Grim of the Intercept about what happens when the government spends without taxing or borrowing (something the United States never does, but bracket that for now), Kelton says it depends on who gets the money. If rich people get it, they’d probably save it. If poor people get it, “they’d spend it into the economy.” She had nothing to say about whether the economy could accommodate that demand. She professed “tremendous respect [for] the real constraints in the economy,” but in fact MMTers have almost nothing to say about those — and Mosler, Tymoigne, and Wray responded to Palley’s comments on the topic with insults. Nor do they ever remind their social media fans, intoxicated by the power of keystrokes, about those constraints.

Sometimes it’s really hard to figure out just what MMTers believe. Are they just saying, in very roundabout ways, that it’s okay for the federal government to run a small deficit in normal times and occasional big ones in crises like 2008? That would be hard for anyone but the most wicked austerity hound to disagree with.

Or is it that we shouldn’t worry about deficits at all? Kelton, asked about the Trump tax cuts, said she was ready for Tax Cuts 2.0. So, should we then not worry about the rising ratio of federal debt to GDP that comes with big deficits, and the increased share of spending devoted to debt service (which is a gift to bondholders, who are mostly quite rich)? Will there never be a point at which even the US government might find it hard to float new bonds to pay off the old ones and finance fresh spending? Debt, as the late sociologist James O’Connor said, increases capital’s power over the state: a government that is not pursuing market-friendly policies will find it hard to get a loan. Is that not a concern? Could we solve that problem by just having the Fed buy the bonds? Aside from the fact that that’s technically illegal, isn’t it a few steps down the road to Weimar? At what point would debt become worrisome? As with inflation, MMTers just never say.

MMTers can have a complicated relationship with facts. In an article offering a strategy for funding a Green New Deal — just spend the money, don’t worry about where it’s going to come from — Stephanie Kelton, Andres Bernal, and Greg Carlock claim that “the government’s bank — the Federal Reserve — clears the payments by crediting the seller’s bank account with digital dollars. In other words, Congress can pass any budget it chooses, and our government already pays for everything by creating new money.” But the government doesn’t do that. It spends only money gotten from tax revenues or bond sales. (If you don’t believe me, look at a Daily Treasury Statement, a daily accounting of the federal government’s income and outgo. It looks a lot like any normal financial statement, only with a lot more zeroes.) The Fed is forbidden by law to purchase bonds directly from the Treasury. The recent episode of quantitative easing (QE), designed to fight the Great Recession, was a partial exception: the Fed did buy huge gobs of Treasury bonds in an effort to stimulate the economy. That program is now over. But even then, the Fed only bought existing securities from private holders; the government cannot spend via keystrokes money created out of thin air.

Compounding the error, Kelton et al. claim money creation out of thin air was “how we paid for the first New Deal. The government didn’t go out and collect money — by taxing and borrowing — because the economy had collapsed and no one had any money (except the oligarchs).” But federal debt more than doubled between 1932 and 1939. That’s not a bad thing, but there’s no point in denying it, unless you’re trying to sell a bill of goods.

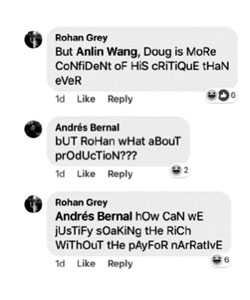

On social media, the style of argumentation is even more striking. Critiques are first met with the assertion that you just don’t understand — you haven’t read enough of the literature to comment knowledgeably. But they’re quick to resort to mockery and insult. One of my favorite instances came from two of the more prominent younger members of the school, who had these persuasive reactions to my critiques on Facebook.

On social media, the style of argumentation is even more striking. Critiques are first met with the assertion that you just don’t understand — you haven’t read enough of the literature to comment knowledgeably. But they’re quick to resort to mockery and insult. One of my favorite instances came from two of the more prominent younger members of the school, who had these persuasive reactions to my critiques on Facebook.

The mass of MMT rank-and-filers on social media are incredibly fervent. One acolyte emitted 220 tweets in response to a critique I’d offered.

MMT’s most charming style of polemicizing comes from Scott Ferguson, a film and media studies academic, author of Declarations of Dependence: Money, Aesthetics, and the Politics of Care. Under the spell of MMT, Ferguson urges radicals to junk “the Marxist image of money as a private, finite, and alienable quantum of value” and discover “money is a boundless public center that can be made to support all.” He proceeds to a series of declarations of a sort you don’t usually find in a university press book:

Seize the money relation!

Enlist the aesthetic in money’s expansion!

Hail money as the center of caretaking!

Declare your dependence on care’s center!

Relinquish attachments to thisness!

Imagine a boundless public center!

Never forsake abstraction for gravity’s attractions!

Exalt abstraction as the locus of care!

It goes on for over two hundred pages, as Ferguson summons Heidegger and the Eucharist to uncover in this new notion of money endless reservoirs and beauty and tenderness. This develops the utopian potential of MMT in ways that are outside the economist’s standard skillset, but it bears a tenuous relation with earthly reality.

I’ve had little good to say about MMT, and a conclusion is not the place to change that. It is a voice against austerity, but with the United States running trillion-dollar deficits, tight fiscal policy isn’t the major enemy right now here. (Europe is a different story, of course.) The major problems at the fiscal level are what we spend money on and what we don’t. If anything, we’re closer to terminal now than we were fifty years ago, when Martin Luther King Jr said, “a nation that continues year after year to spend more money on military defense than on programs of social uplift is approaching spiritual death.”

More broadly, we have a private economy driven by exploitation, overwork, asset stripping, and ecological destruction. MMT has little or nothing on offer to fight any of this. The job guarantee is a contribution, though a flawed one, and it’s not at the core of the theory, which proceeds from the keystroke fantasy. That fantasy looks like a weak response to decades of anti-tax mania coming from the Right, which has left many liberals looking for an easy way out. It would be sad to see the socialist left, which looks stronger than it has in decades, fall for this snake oil. It’s a phantasm, a late-imperial fever dream, not a serious economic policy.